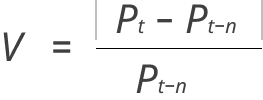

The trading system incorporates multiple protective mechanisms to ensure no trades are executed during extreme market conditions

𝑃𝑡: Price at the current time 𝑡; 𝑃𝑡−𝑛: Price within a time window of 𝑛; 𝜃: Volatility protection threshold; 𝑉: Volatility indicator; When 𝑉≥𝜃, it is considered that the price volatility is too high, and the system will not participate in trading; when 𝑉<𝜃, the price volatility is within a reasonable range, and the system can consider proceeding to the next logical confirmation.

If the current price 𝑃𝑡 deviates from the past price 𝑃𝑡−𝑛 by more than a set threshold ratio 𝜃, the system will temporarily halt trading to avoid trading during excessive market volatility. By adjusting the value of 𝑛 and the threshold 𝜃, the trigger frequency can be flexibly controlled.

Our event-driven investment strategy executes trades only upon specific signal occurrences, prioritizing capital security

𝜇: Vector of expected asset returns; Σ: Asset covariance matrix; γ: Risk aversion coefficient; w: Vector of asset weights;𝜃: Event signal; 𝜃threshold: Event signal threshold; 𝐿max: Maximum loss limit.

Under the trigger condition, maximize the portfolio's risk-adjusted return.

Risk constraint: Ensure the portfolio's risk![]() does not exceed

does not exceed![]() .

.

Trigger condition: Perform optimization only when 𝜃>𝜃threshold; otherwise, the system remains in a non-trading state.

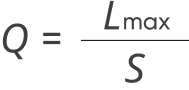

Stop-loss and take-profit points are strictly set based on risk control requirements

𝐿max: Maximum loss amount; 𝑄: Amount of capital per trade; 𝑆: Expected stop-loss price difference;

Ensures that the total loss from trades does not exceed 𝐿max under extreme price fluctuations.

Set the maximum allowable loss 𝐿max=1000 USD. The stop-loss range per contract unit 𝑆=10 USD. Substituting into the formula, we get:

𝑄 =1000/10=100

Thus, in the worst-case scenario, the total trading loss remains controlled within 1000 USD.

Tmax:Maximum holding time; 𝑡:Elapsed holding time; 𝑃entry:Entry price; 𝑃current:Current price; 𝑅:Expected take-profit yield; 𝑉:Market volatility;

Condition 1: Close the position when the profit reaches the expected yield;

Condition 2: Force the closure of the position when the holding time reaches the maximum limit.

Assume:

Maximum holding time 𝑇max=10 minutes, Entry price 𝑃entry=100 USD, Current holding time 𝑡=9 minutes, with current market price 𝑃current=105 USD, The model calculates a suitable take-profit return rate 𝑅=4%.

Since 𝑃current=105 exceeds 100×(1+0.04)=104, this triggers the take-profit exit.

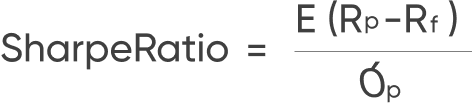

Strategies trained, developed, and executed through AI feature high returns, high Sharpe ratios, and high liquidity

Rp represents the expected return of the portfolio. In 2024, there are 262 trading days. As of September 26, 2024, 220 trading days have passed, with a total return of 33.95%. The expected return for the entire year is calculated as follows: Rp = (33.95% * 262 / 220) = 40.431%.

Rf represents the risk-free interest rate, calculated at 2.12% .

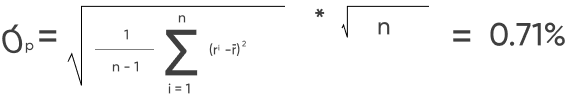

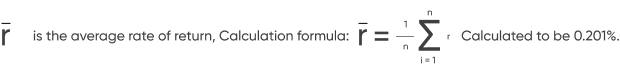

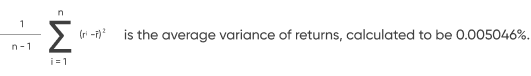

δp is the annualized standard deviation of the portfolio return rate, calculated using the formula:

SharpeRatio =(33.95%*262/220 - 2.12%)/7.67% = 4.99

In the execution of AI strategies, to mitigate the potential financial losses caused by sudden risks, two types of constraints—"maximum loss limit" and "maximum holding time"—are set in advance for each trade. When encountering unexpected risks, the AI strategy assesses the impact and duration of the risk based on a stop-loss logic. Once the holding time reaches the "holding time line," the position will be closed regardless of whether it is profitable. Additionally, if the losses caused by the risk reach the maximum loss threshold, this will also trigger a position closure.

Calculation of AI Win Rate

AI has a high success rate in judgment, but the actual win rate is affected by the market environment. Therefore, the success probability of each trade can be represented by the following formula:

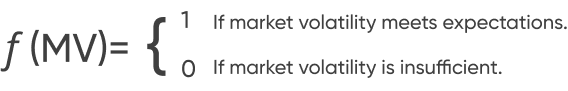

PAI represents the success rate of AI judgment, while 𝑓(𝑀𝑉)denotes the market volatility influence factor.

Calculation of the Market Volatility Influence Factor 𝑓(𝑀𝑉)

Market volatility can affect execution effectiveness; if volatility is insufficient, it may lead to an inability to profit.

MV represents market volatility.

Risk Control Mechanism

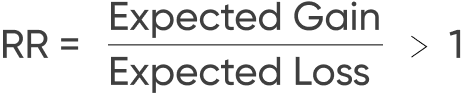

The AI strategy exits immediately when there are losses and aims to maximize profit margins when there are gains; therefore, the actual winning rate of profits should also consider the profit-loss ratio (R).

Assuming the profit-loss ratio is sufficiently large, the profit-loss ratio RR for each trade should be greater than 1:

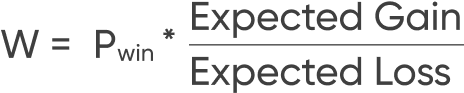

Final Win Rate (W)

The final win rate, considering market volatility and the profit-loss ratio, can be expressed as:

The trading method based on "high-speed low-frequency" will provide

a more stable source of income.

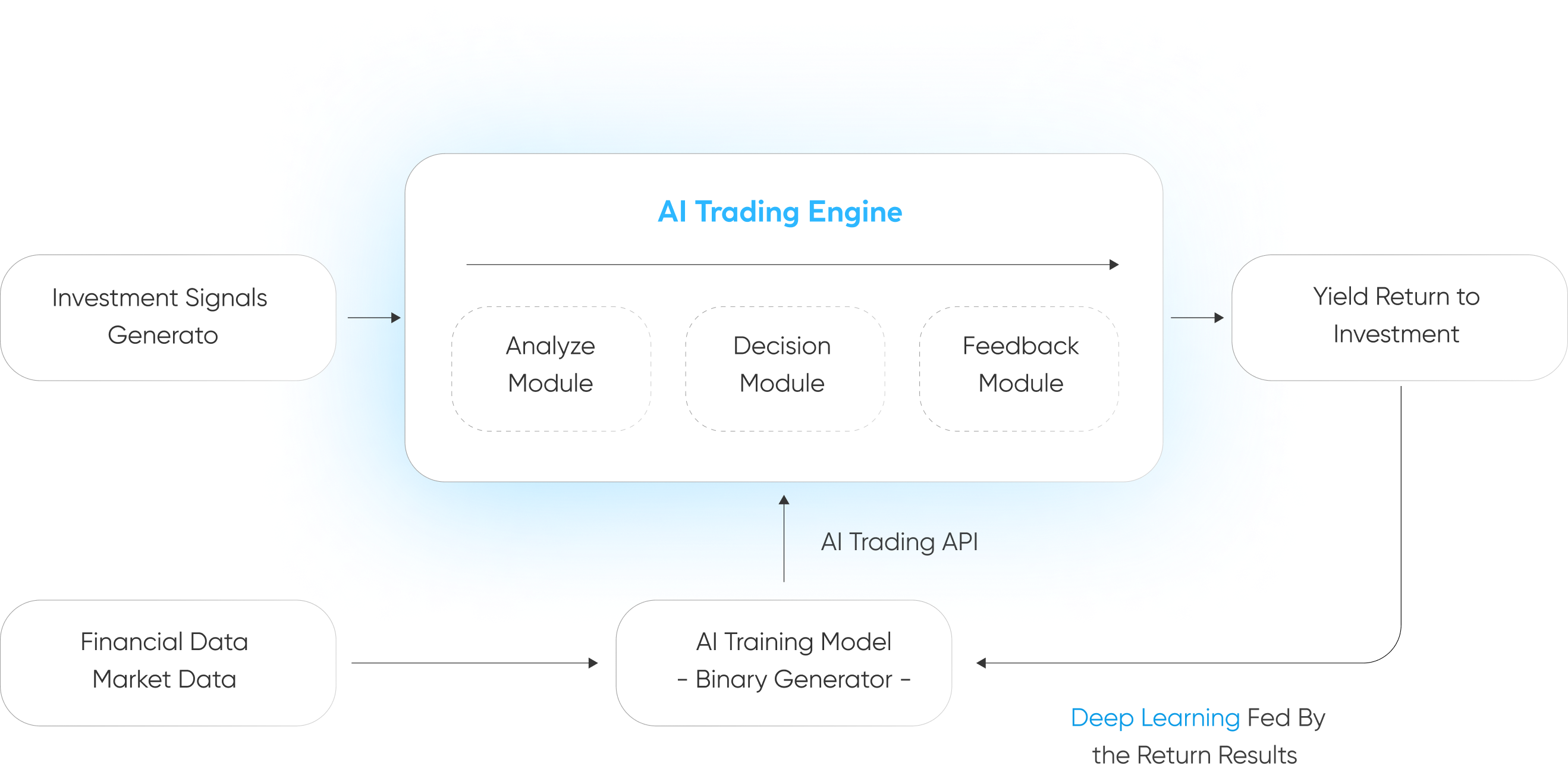

The AI strategy of DeepEarning adopts an event-driven approach, capturing precise trading signals and achieving optimal returns in the market through agile and flexible trading behavior.

AI Quant Strategy RWA Would be the Reliable Solution for Underlying Asset

Investment Signal = 𝑓(Price Data,News,Macro Reports)

such as asset prices, news, and macroeconomic reports, to generate investment signals.

Decision = 𝑓(Investment Signal, Market Trends) (Position Size, Direction, Timing

The AI model analyzes investment signals based on real-time data, deciding whether to trade, the direction of investment, and the size of the position, while analyzing market trends and the optimal time for closing positions.

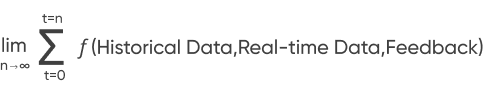

Updated Strategy = Deep Learning(Historical Trades, Real-time Feedback)

After each transaction is completed, the system will provide feedback on the outcome of the transaction and use deep learning to optimize future strategies.

Based on historical and real-time data, the AI model continuously iterates and improves, enhancing its adaptability and predictive ability, forming a closed-loop process of signal-decision-feedback, and achieving automated investment.